Managing your cross-border fund distribution

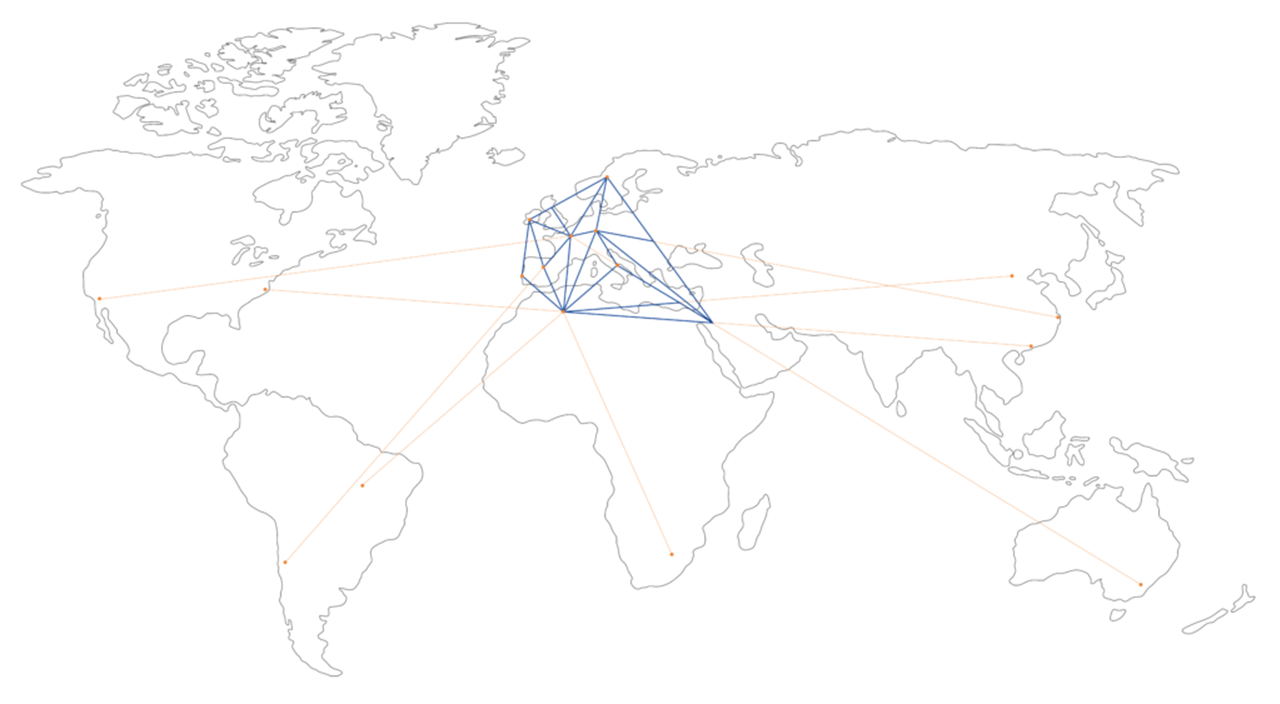

Our established network connects major fund centres globally.

Read moreProfilir - Digitally connecting people, capital & insights

A digital marketing platform designed specifically for asset managers.

Visit the Apex Group websiteDriving meaningful and measurable change

Via Apex Group, Secure a more sustainable future with our ESG Ratings and Advisory Solution.

Visit Apex Group website